A Firm Has a Debt to Equity Ratio of .5

So after solving this ROA would be. Current ratio 15.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Definition

Its cost of equity is 22 and its cost of debt is 16.

. V D E 2000. Calculate the after-tax weighted average cost of capital WACC. R E 12 and T C 30.

And the firm has 50 debt and 50 equity. When a business has a high debt to equity ratio it has imposed on itself a large block of fixed cost in the form of interest expense which increases its breakeven point. Increase the debt-to-equity ratio to 057.

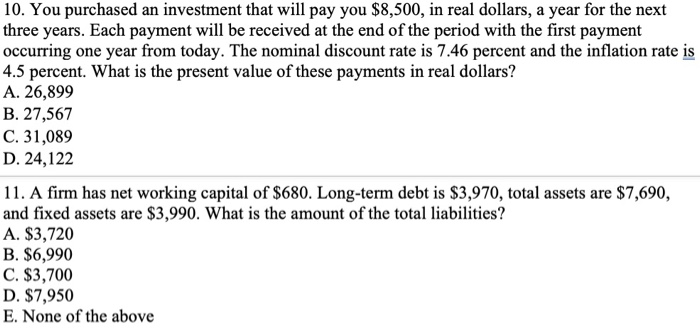

ROA 00761 15. If Debt Equity 1 then Debt Equity so total assets are twice equity. A firm has a debt-to-equity ratio of5.

Each has 25 million in invested capital has 5 million of EBIT and is in the 40 federal-plus-state tax bracket. ROA Asset turnover Operating profit margin 3 05 1500 or 1500. Round your answer to 2 decimal places.

DV 8002000 04 40. The financial statements are key to both financial modeling and accounting the total debt of a business is worth 50. R D 6.

Equity E 300 Million. If as per the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. None of the above.

A firm has a debt to equity ratio of 5 Its cost of equity is 22 and its cost of from ADM 3350 at University of Ottawa. If the corporate tax rate is 40 what would its cost of equity be if the debt-to-equity ratio were 0. D e b t - t o - e q u i t y 2 4 1 0 0 0 0 0 0 1 3 4 0 0 0 0 0 0.

Quick ratio 125 total assets curr assets fixed long term assets 400000 curr assets 100000 300000 curr ratio curr assetscur liabilities. A firm has a debt to equity ratio of 40 debt of 250000 and net income of 100000. 00461 003 15 ROA.

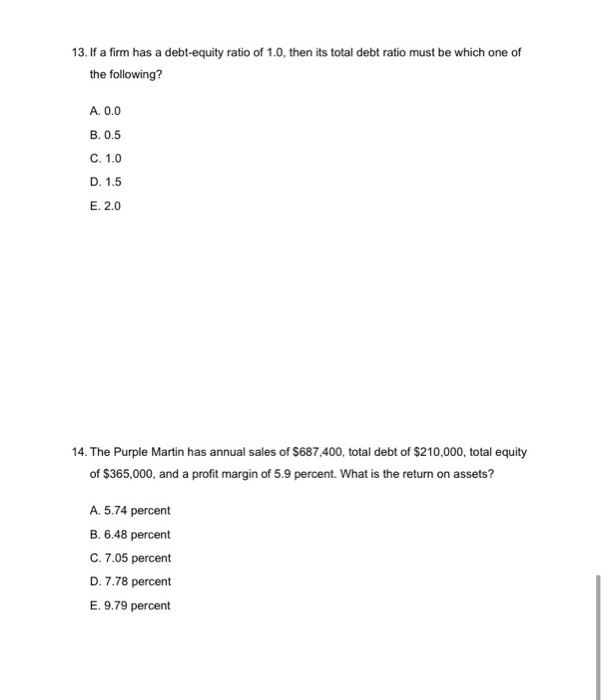

If the corporate tax rate is 40 what would its cost of equity be if the debt-to-equity ratio were 0. A firm has a debt-to-equity ratio of 5. Debt D 100 million.

Tax rate 35. The return on equity is. Zvi Bodie Alan J.

What is the ratio of the book value of debt to the market value of equity. D 800 1 800. A firm has a debt-to-equity ratio of 5.

Using the above formula the debt-to-equity ratio for AAPL can be calculated as. A firm has a debt to equity ratio of 40 debt of 250000 and net income of 100000. The optimal DE ratio varies.

Big Bath Emporium BBE a private company based in Toronto is the. Use market values in Millions. ROE 1 - tax rate ROA ROA - Interest Rate Debt Equity 3 1 - 035 ROA ROA - 006 05 3 065 ROA 05 ROA - 003 003 065 15 ROA - 003.

Debt to Equity Ratio in Practice. A firm has a debt-to-equity ratio of 5. A firm has a debt-to-equity ratio of 5.

Marcus Alex Kane Rent Buy. What is its equity multiplier. A firm has an ROE of 3 a debtequity ratio of 5 a tax.

Firm HL however has a debt-to-capital ratio of 55 and pays 11 interest on its debt whereas LL has a 20 debt-to-capital ratio and pays only 10 interest on its debt. This situation means that it takes more sales for the firm to earn a profit so that its earnings will be more volatile than would have been the case without the debt. Its cost of equity is 22 and its cost of debt is 16.

Increase the debt-to-equity ratio to 067. Leave the debt-to-equity ratio unchanged at 05. The debt-to-equity ratio is calculated by dividing a corporations total liabilities by its shareholder equity.

Neither firm uses preferred stock in its capital structure. Cost of debt rD 6. A firm has a ROAof 35 a debt to equity ratio of.

300000200000 15 quick ratio curr assets - invent curr liabilities 300000-50000200000 125. Cost of equity rE 121. Finance questions and answers.

If a company has a quick ratio of 125 times current assets of 25000 and inventory of 5000 the current liabilities balance is equal to _ 16000 25000 - 5000 20000 125. EV 12002000 06 60 Given the following data. A firm has a debt-to-equity ratio of 060 and a market-to-book ratio of 25.

Essentials of Investments 8th Edition Edit edition Solutions for Chapter 14 Problem 9P. 1 25 3 15 2 This problem has been solved. Its cost of equity is 22 and its cost of debt is 16.

Do not round intermediate calculations. Debt ratio 1- 1 3 2 3 67 which is exactly the result we found above. If the corporate tax rate is 40 what would its cost of equity be if the debt-to-equity ratio were 0.

1 25 3 15 2 What is its equity multiplier. 945 Note that fter-tax WACC 141 - 036 3412 1005. The firm acquires new equipment with a 3-year operating lease that has a present value of lease payments of 12 million.

Net income EBIT - Interest - Taxes 20000 - 8000 - 8000 4000. Debt-equity ratio Total debt Total equity Debt-equity ratio 2014 93800 42000 264200 51 times Debt-equity ratio 2015 104250 40000 355750 41 times Equity multiplier 1 DE Equity multiplier 2014 1 51 151 Equity multiplier 2015 1 41 141 f. The most appropriate analyst treatment of this operating lease will.

A firm has a ROAof 35 a debt to equity ratio of 5 a tax rate of 35 and pays an interst rate of 6 on its debt What is its operating ROA. Given the following data for UP Company. ROE AssetsEquity ROA Net incomeAfter-tax operating income.

Debt ratio 1- 1 Equity multiplier Lets verify the formula for company A. Debt to Equity Ratio short term debt long term debt fixed payment obligations Shareholders Equity. Its cost of equity is 22 and its cost of debt is 16.

E 12 100 1200. The return on equity is.

Solved A Firm Has A Debt To Equity Ratio Of 0 50 Its Cost Chegg Com

Solved 13 If A Firm Has A Debt Equity Ratio Of 1 0 Then Chegg Com

Solved 8 If A Firm Has A Debt Equity Ratio Of 1 5 Then Its Chegg Com

Comments

Post a Comment